And the winner for retirement savings is…

The Office for National Statistics (ONS) has been looking at attitudes to private savings.

Which one of the options below do you think would be the safest way to save for retirement?

| 1. Paying into an employer pension scheme |

5. Saving into a high rate savings account |

| 2. Paying into a personal pension scheme |

6. Saving into an ISA (or other tax-free savings account) |

| 3. Investing in the stock market by buying stocks or shares |

7. Buying Premium Bonds |

| 4. Investing in property |

8. Other |

The ONS regularly carries out a “Wealth and Assets Survey” asking the above question. The most popular answer in the latest round of the survey was, somewhat predictably, 1. Paying into an employer pension scheme, selected by 41% of respondents. More interesting was the winner from the same list of options to the follow up question

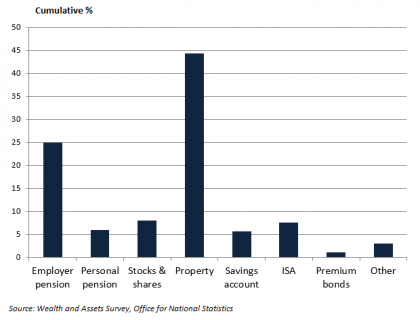

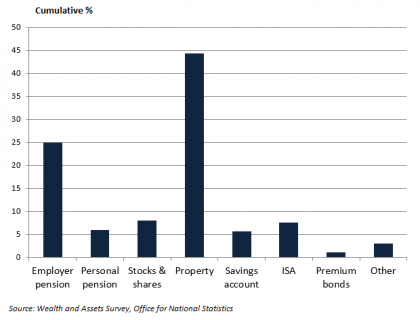

“And which do you think would make the most of your money?”, as shown in the graph below.

Unfortunately, the ONS is not specific about the type of property, although it is a reasonable assumption that most of those replying are thinking in terms of the residential type rather than commercial buildings. Earlier surveys have produced very similar results.

Very few investment professionals would be likely to choose property, particularly if it was residential bricks and mortar, so why does the Great British Public? Some of it is down to the simple truth that many people are more familiar with the performance of house prices than other assets. Then there is the fact that when people think about how much the value of their homes has increased they tend to forget about the mortgages which had to be financed. Borrowing to boost returns is a long-standing investment technique, but it can go badly wrong – witness the negative equity problems in the mid-1990s. Selective memory also plays an important role. For example,

UK property prices have on average risen by 17% in the last five years, according to Nationwide. In the previous five years the rise was just over 6%.

If you were tempted to answer ‘property’ to the second question, do talk to us about what the other options can offer and the impact of the latest planned buy-to-let tax changes announced in the Autumn Statement.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

Please call us today if you’d like to discuss this further.

T: 020 7376 9333

E: info@figurit.com

Related Articles

–

Buy-to-let: a future tax trap?

–

Financing start ups with SEIS

Unfortunately, the ONS is not specific about the type of property, although it is a reasonable assumption that most of those replying are thinking in terms of the residential type rather than commercial buildings. Earlier surveys have produced very similar results.

Very few investment professionals would be likely to choose property, particularly if it was residential bricks and mortar, so why does the Great British Public? Some of it is down to the simple truth that many people are more familiar with the performance of house prices than other assets. Then there is the fact that when people think about how much the value of their homes has increased they tend to forget about the mortgages which had to be financed. Borrowing to boost returns is a long-standing investment technique, but it can go badly wrong – witness the negative equity problems in the mid-1990s. Selective memory also plays an important role. For example, UK property prices have on average risen by 17% in the last five years, according to Nationwide. In the previous five years the rise was just over 6%.

If you were tempted to answer ‘property’ to the second question, do talk to us about what the other options can offer and the impact of the latest planned buy-to-let tax changes announced in the Autumn Statement.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

Please call us today if you’d like to discuss this further.

T: 020 7376 9333

E: info@figurit.com

Unfortunately, the ONS is not specific about the type of property, although it is a reasonable assumption that most of those replying are thinking in terms of the residential type rather than commercial buildings. Earlier surveys have produced very similar results.

Very few investment professionals would be likely to choose property, particularly if it was residential bricks and mortar, so why does the Great British Public? Some of it is down to the simple truth that many people are more familiar with the performance of house prices than other assets. Then there is the fact that when people think about how much the value of their homes has increased they tend to forget about the mortgages which had to be financed. Borrowing to boost returns is a long-standing investment technique, but it can go badly wrong – witness the negative equity problems in the mid-1990s. Selective memory also plays an important role. For example, UK property prices have on average risen by 17% in the last five years, according to Nationwide. In the previous five years the rise was just over 6%.

If you were tempted to answer ‘property’ to the second question, do talk to us about what the other options can offer and the impact of the latest planned buy-to-let tax changes announced in the Autumn Statement.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

Please call us today if you’d like to discuss this further.

T: 020 7376 9333

E: info@figurit.com