Income tax changes

The burden of income tax was reduced slightly in the Budget, but anomalies remain.

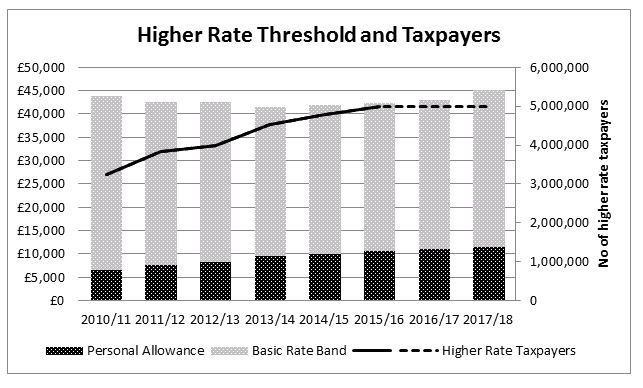

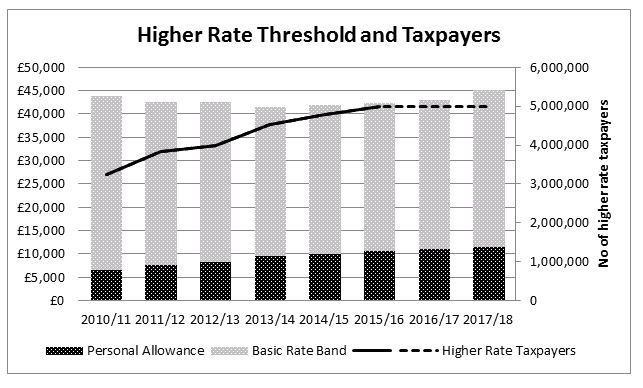

The personal allowance will rise

from £11,000 to £11,500 in 2016/17 and the higher rate threshold –

the starting point for 40% tax – will rise by £2,000 to £45,000. While the Treasury described the increase in the higher rate threshold as “the biggest above inflation cash increase to this threshold since it was introduced by Lord Lawson in 1989”, that does not tell the whole story in a zero inflation environment.

According to the Institute for Fiscal Studies, if there had been no reforms to the higher rate tax threshold rules since 2010, the number of higher rate taxpayers would now be 36% (1.8m)

less than is currently the case. And higher rate tax is not the end of the story, by any means:

- The starting point for additional rate has been frozen at £150,000 since it was introduced in April 2010. Similarly, the income level at which child benefit starts to be taxed has remained at £50,000.

- The higher personal allowance will widen the band above £100,000 of income in which an effective tax rate of 60% applies – in 2017/18 it will reach up to £123,000. Ironically, tax payers (but not the Exchequer) would be better off if the additional rate tax (at 45%) started at £100,000.

- The cliff edge at which the availability of the transferable marriage allowance is lost will move up to £45,000 in line with the higher rate threshold, but £1 of extra income above that could potentially mean an extra £230 in tax.

- The increase in the higher rate threshold will be matched by an increase in the upper earnings limit for national insurance contributions (NICs), meaning that for many a large part of the tax saving will be countered by higher NICs.

- At the other end of the NICs scale, the gap between the personal allowance and the threshold for NICs is ever-widening. For example, in 2016/17 there is nearly a £3,000 gap between the starting point for NICs (£8,060) and the personal allowance (£11,000). Unless the NIC threshold rises sharply in 2017/18 – and it is usually inflation linked – then the gap will widen further.

All of which is a reminder of that Budgets may come and go, but personal tax planning will always be necessary.

The value of tax reliefs depends on your individual circumstances. Tax laws can change. The Financial Conduct Authority does not regulate tax advice.

Call the team today if you’d like to discuss this further.

T: 020 7376 9333

E: info@figurit.com

Related Articles

–

Are you using all your taxable allowances?

–

2015-2016 Summary of tax rates, reliefs and allowances

–

Breaking the PAYE code

According to the Institute for Fiscal Studies, if there had been no reforms to the higher rate tax threshold rules since 2010, the number of higher rate taxpayers would now be 36% (1.8m) less than is currently the case. And higher rate tax is not the end of the story, by any means:

According to the Institute for Fiscal Studies, if there had been no reforms to the higher rate tax threshold rules since 2010, the number of higher rate taxpayers would now be 36% (1.8m) less than is currently the case. And higher rate tax is not the end of the story, by any means:

All of which is a reminder of that Budgets may come and go, but personal tax planning will always be necessary.

The value of tax reliefs depends on your individual circumstances. Tax laws can change. The Financial Conduct Authority does not regulate tax advice.

Call the team today if you’d like to discuss this further.

T: 020 7376 9333

E: info@figurit.com

All of which is a reminder of that Budgets may come and go, but personal tax planning will always be necessary.

The value of tax reliefs depends on your individual circumstances. Tax laws can change. The Financial Conduct Authority does not regulate tax advice.

Call the team today if you’d like to discuss this further.

T: 020 7376 9333

E: info@figurit.com